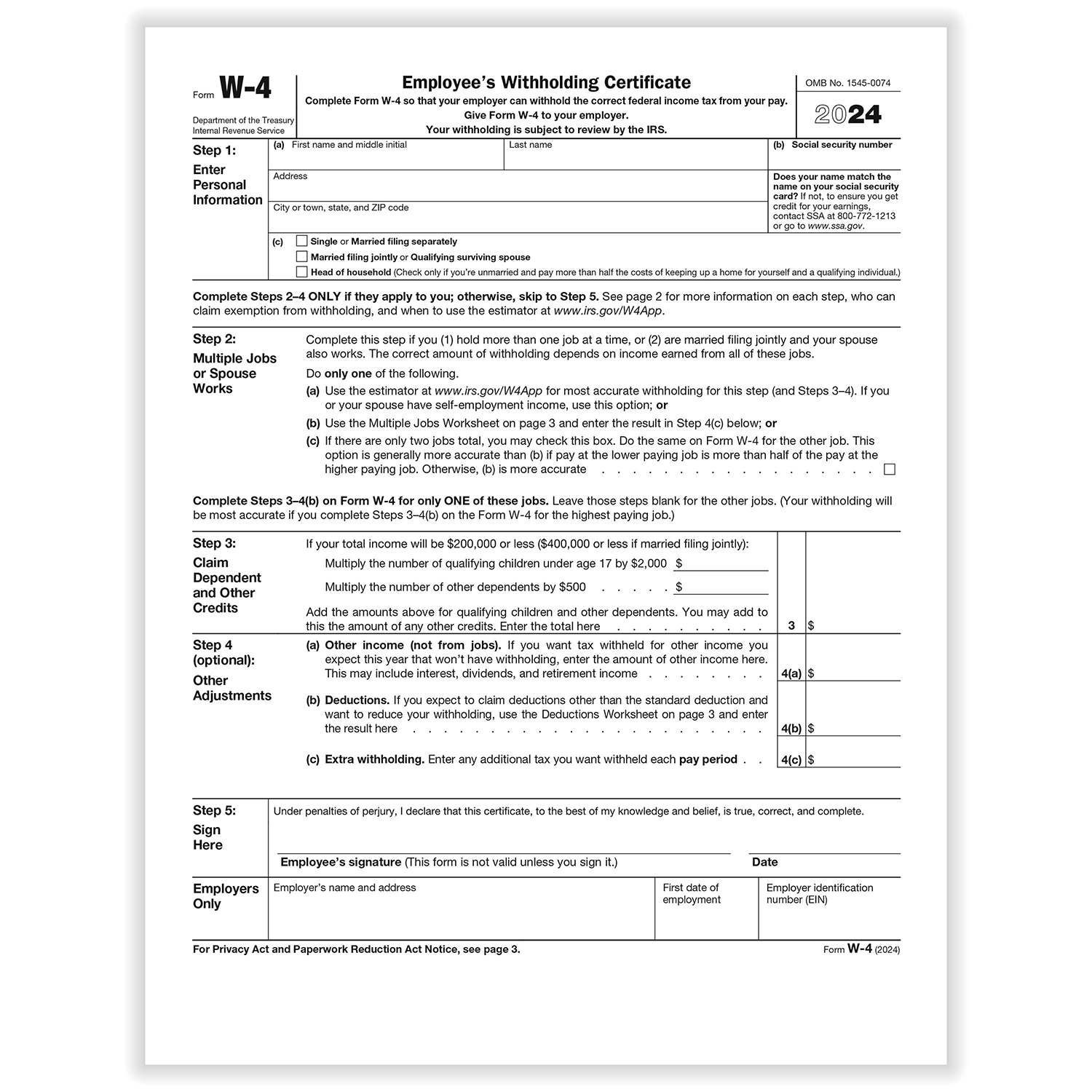

1099 Employee Form Printable 2024 Irs – This story is part of Taxes 2024, CNET’s coverage since anyone issuing a W-2 or 1099 will also issue a copy to the IRS. Employees receive a W-2, whereas a 1099 form documents income you . Fortunately, there are plenty of tax-advantaged options available for 1099 workers The SIMPLE IRA employee contribution limit is $16,000 in 2024. There is also a $3,500 catch-up contribution .

1099 Employee Form Printable 2024 Irs

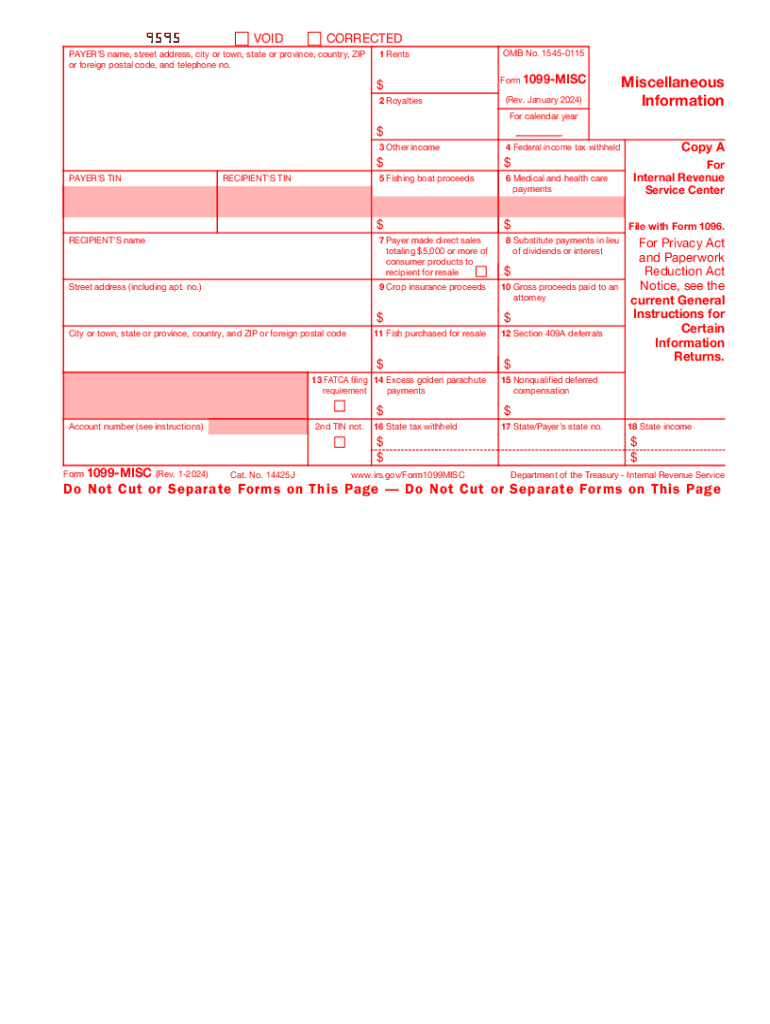

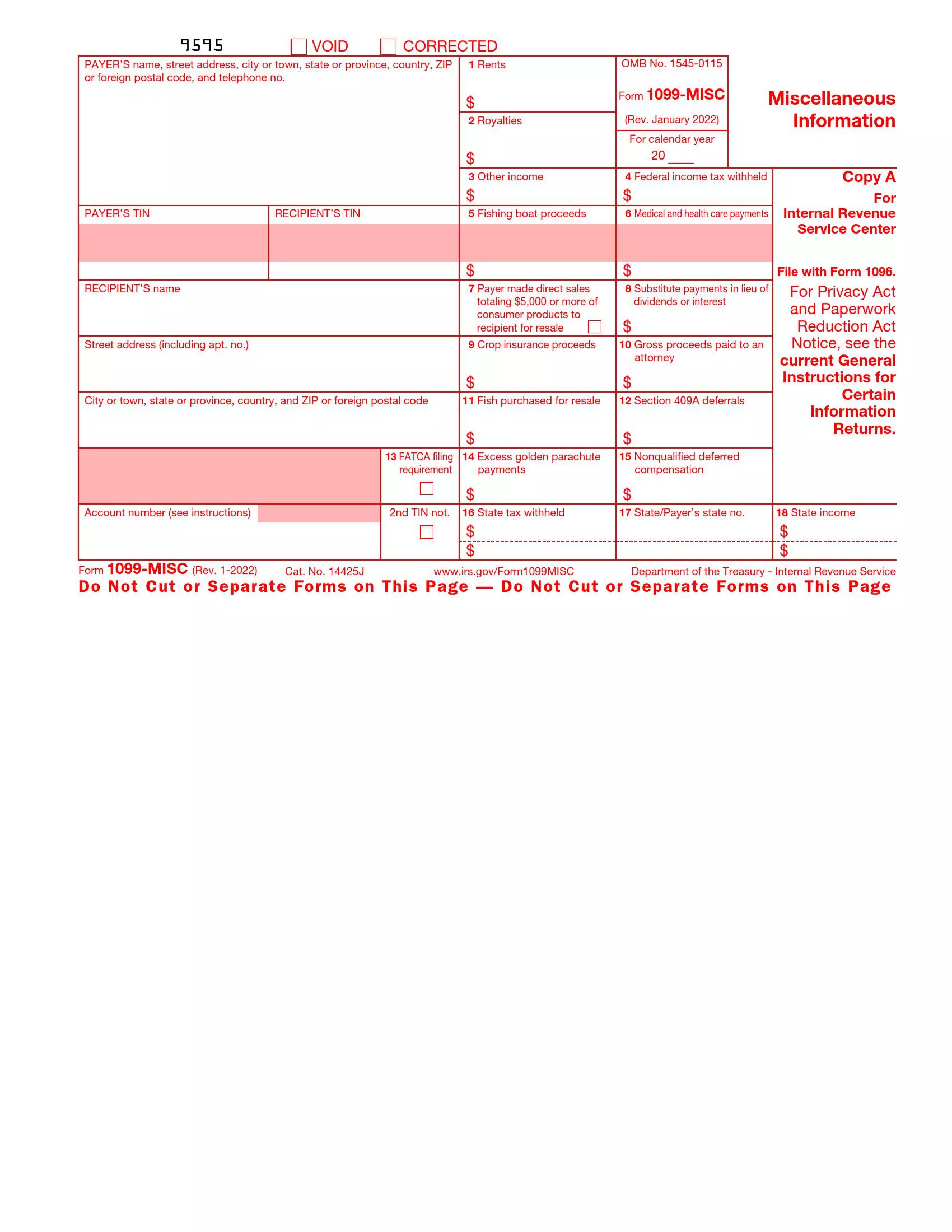

Source : eforms.com2024 Form IRS 1099 MISC Fill Online, Printable, Fillable, Blank

Source : 1099-misc-form.pdffiller.com2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.com2024 Form IRS 1099 MISC Fill Online, Printable, Fillable, Blank

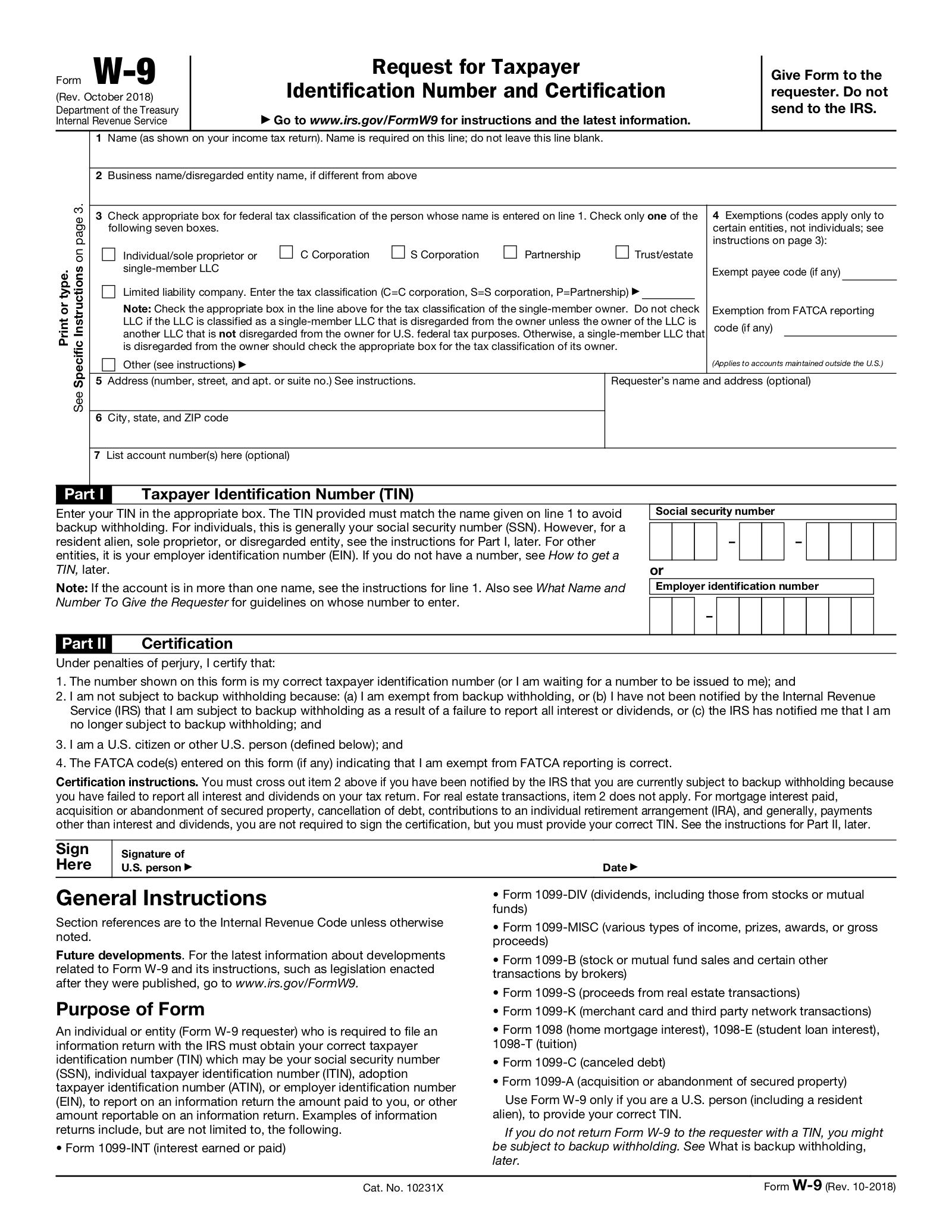

Source : 1099-misc-form.pdffiller.comFree IRS Form W9 (2024) PDF – eForms

Source : eforms.comIRS Form 1099 Reporting for Small Businesses

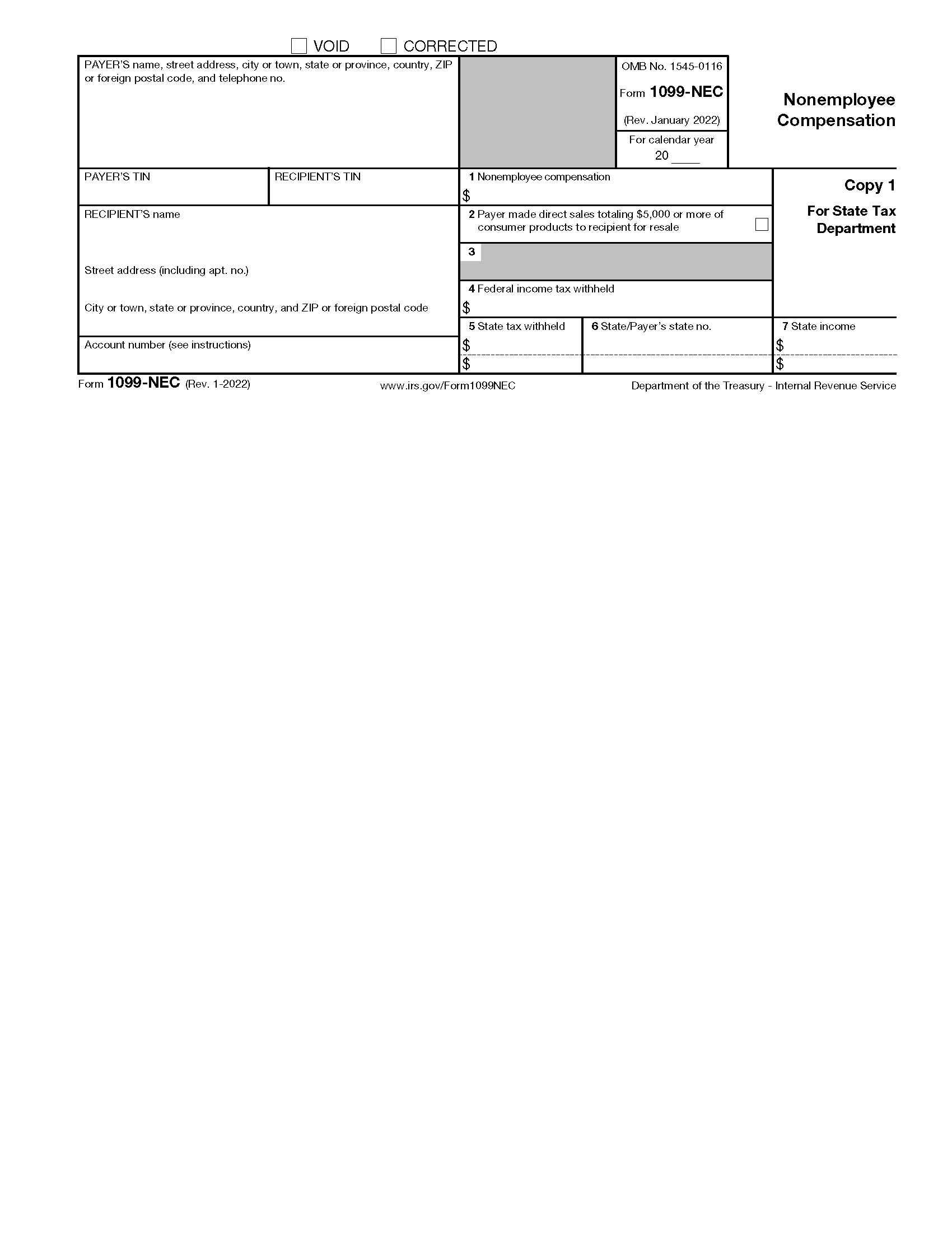

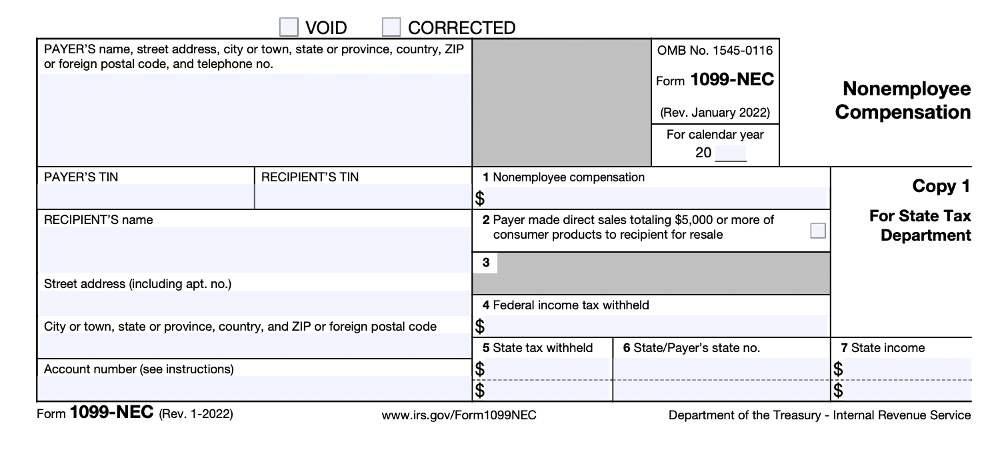

Source : fitsmallbusiness.comFree IRS 1099 NEC Form (2021 2024) PDF – eForms

Source : eforms.comIRS Form 1099 MISC ≡ Fill Out Printable PDF Forms Online

Source : formspal.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.comInstructions for Forms 1099 MISC and 1099 NEC (Rev. January 2024)

Source : www.irs.gov1099 Employee Form Printable 2024 Irs Free IRS 1099 NEC Form (2021 2024) PDF – eForms: The IRS launched IRIS, a new free online portal, for businesses to file 1099 returns. (Beginning January 2024 old Box 7 of Form 1099-MISC. “NEC” stands for “non-employee compensation”. . The $600 threshold for payment apps and online marketplaces to report payments on Form 1099-K is delayed for tax year 2023. The IRS is planning a threshold of $5,000 for tax year 2024. A 1099-DIV .

]]>